Coffee Market Report- October 2025

17 October 2025

At a glance:

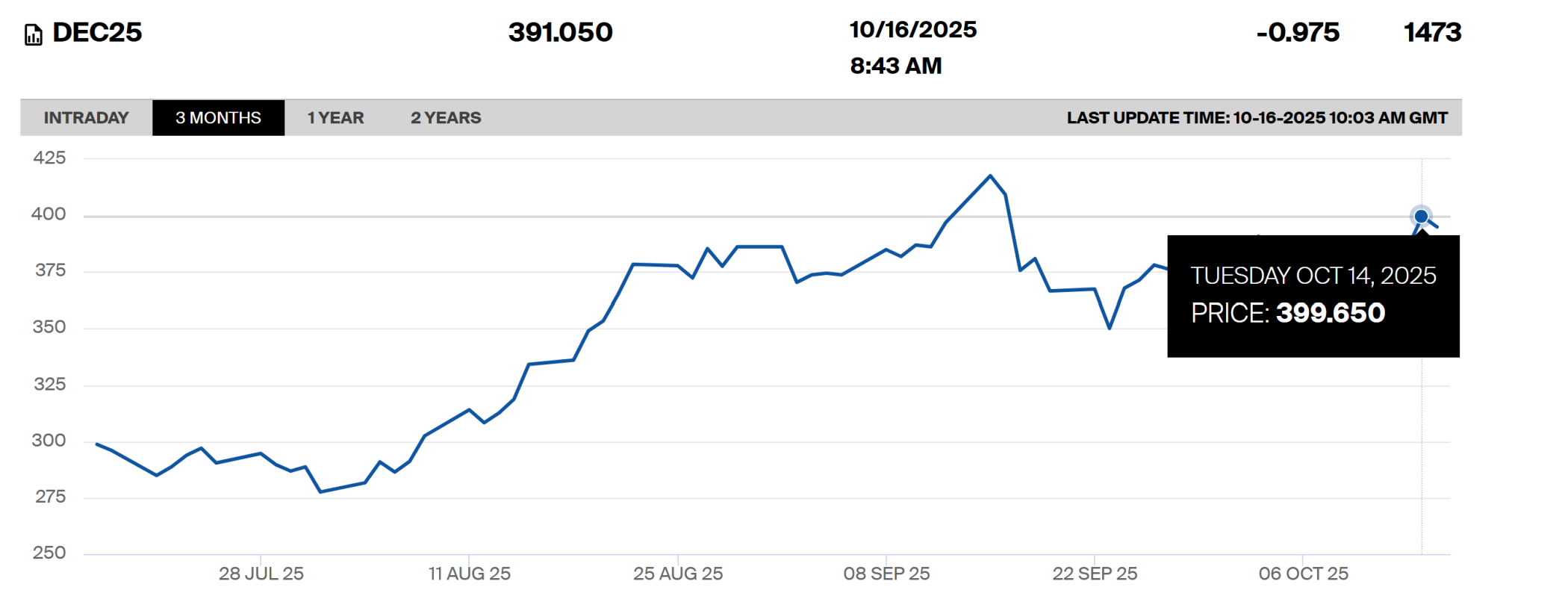

• Global coffee prices resumed a sharp upward climb, hitting 400 c/lb in the third week of October.

• US tariffs on Brazilian coffee are reshaping trade flows and spurring volatility.

• Adverse weather in Brazil and Vietnam is adding fresh pressure on supply.

Global coffee prices continued their strong upward climb last week, reaching just below 400 c/lb on Tuesday 14th October — fuelled by weather concerns and newly imposed trade tariffs.

At an origin level, this is a critical period for rainfall in Brazil. Moisture during this phase is essential to trigger flowering in the 2026/27 crop. Reports last week pointed to hotter and drier-than-normal conditions, raising fears of stress on the plants. In Vietnam, the aftermath of a typhoon at the end of September caused flooding in key coffee-growing regions, temporarily disrupting supply flows. Brazil and Vietnam are important drivers of the coffee price, as they are the largest global producers of Arabica and Robusta respectively.

Whilst it is widely agreed that 2025/6 will see a fifth year of global supply deficit, the outlook for 2026/27 is currently more positive. Providing the weather conditions stay optimum in Brazil and Vietnam, we could see a surplus year which will relieve pressure on prices in Q2 2026. However, this is a critical period for rains, and the market is likely to react with more velocity to dry periods (as seen on 14/10).

In addition to the weather, the volatility in the market is also being driven by trade policy. The recently instated 50% US import tariff on Brazil has prompted many roasters to cancel forward contracts and draw down exchange-certified stocks, or switch to other origins with lower tariff rates instead. Brazil accounts for roughly one third of US coffee imports, so this shift is causing a deeper global realignment in supply chains as Brazil looks for new buyers, many of whom are in China and Asia.

In short, the tariff dynamics have intensified what is already a fragile market — one contending with climate volatility, logistic constraints, and a multi-year global supply deficit. In addition to reacting to traditional supply/demand patterns, prices are also reacting to geopolitical headline shocks, making planning and hedging increasingly complex.

As such, we expect continued volatility and unpredictability in the coffee market until into 2026.

_____________________________________________________________________________________

Ringtons’ perspective

At Ringtons, we remain vigilant to global coffee market developments. Our long-term supplier relationships, diversified sourcing strategy, and risk-management practices help us absorb shocks and maintain supply continuity — ensuring our customers receive consistent, high-quality coffee even in turbulent market conditions.

This report is for information purposes only and should not be treated as advice or predications of future markets.

Contact our friendly team

If you have any questions or want to talk through what this means for your business, we’re here.

T: 0800 0461 444

E: business@ringtons.co.uk